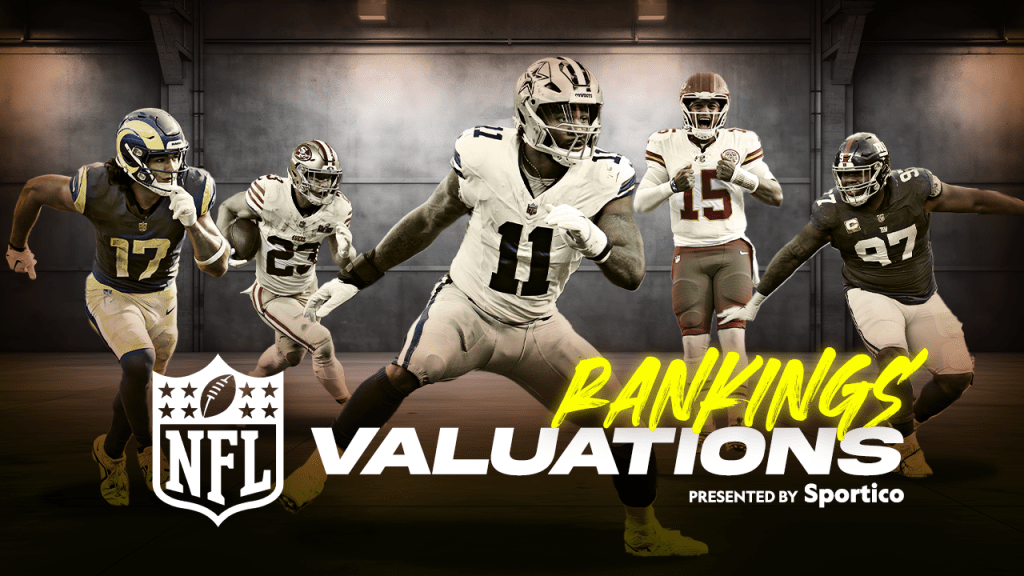

Which NFL Team Shockingly Surged to the Top of the Franchise Valuations?

2025 Valuation: The sum of the enterprise value of an NFL franchise combined with the value of team-related businesses and real estate holdings.

Team Value: NFL franchise valuation, derived from metrics by which football-team transactions occur, including aggregating local and national revenues and factoring in a team-specific multiplier. This represents the market value of the team itself, excluding related businesses held by its owners. It includes the value of each franchise’s 3.13% interest in the league’s properties, including NFL Films, NFL RedZone, 32 Equity (the private equity investment vehicle established by the NFL in 2013) and its digital platforms, which are acquired/dispossessed in tandem with the sale of a team.

For franchises that do not own their venues, the value of a team’s lease—often with advantageous terms negotiated with municipal or state authorities—is captured in the Team Value category.

When you really dig into the financial heartbeat of the NFL, there’s more than just touchdowns and tackles driving these teams’ worth. The 2025 NFL franchise valuations aren’t just about the teams themselves; they’re a complex cocktail of the core squad’s value, plus an intricate portfolio of related businesses and real estate holdings that make up the full financial playbook. What’s fascinating here is how the team’s worth covers everything from local game-day revenue streams to their slice of the league’s collective ventures—think NFL Films and digital platforms—all wrapped up in a neat, albeit hefty, market price tag. Then you’ve got owners’ equity tying into stadium operations, sprawling land parcels, and even high-octane events like the F1 Miami Grand Prix. Now, they’re careful to exclude certain peripheral assets—no counting rental income from adjacent retail ventures or licensing fees that piggyback off the team’s brand. It’s a smart distinction, making sure these valuations spotlight what truly anchors each franchise’s financial muscle. And for those teams without stadium ownership, the value of their stadium leases—often struck with savvy local deals—gets folded back into their core team value. Poring over these layers isn’t just numbers—it’s a glimpse into how sport, business, and real estate intersect in the gritty gridiron landscape. LEARN MORE

Team-Related Businesses and Real Estate Holdings: The value of a franchise owner’s equity in team-related businesses that are distinct corporate entities, as well as government-assessed real estate related to venue, practice facilities and adjacent developments. Examples include Cowboys owner Jerry Jones’ 20% interest in Legends Hospitality, a stadium operations corporation; the Washington Commanders’ subsidiaries, which own nearly 400 acres split between 12 parcels near the team’s stadium and practice facility; and the F1 Miami Grand Prix, which Dolphins owner Stephen Ross has a 15-year contract to operate around Hard Rock Stadium.

This category excludes value derived from enterprises determined as too attenuated from the football team’s operations, which fall into three categories:

(1) Rent from non-football, outside-of-stadium retail operations, like the Green Bay Packers’ Titletown venture or New England Patriots’ Patriot Place.

(3) Team owner’s investment in businesses unrelated to franchise operations. Examples include the Cowboys’ sister company Blue Star Land’s joint ventures with real estate partners.

(2) Licensing fees paid by non-football third parties to a team’s sister company for the use of intellectual property.

Post Comment