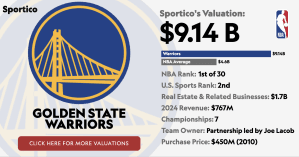

“From Underdogs to Unicorns: The Shocking $9.14 Billion Valuation of the Golden State Warriors”

As I sit down to share the latest bolt from the blue in the NBA world, it’s with a mix of excitement, and a touch of nostalgia, that I pen this introduction.

The Golden State Warriors, fresh off clinching their spot in the playoffs by besting the Memphis Grizzlies in a thrilling Play-In showdown, are once again poised to demonstrate their perennial prowess on the hardwood. Yeah, they’re the seventh seed, locked and loaded for a showdown with the Houston Rockets come this Sunday, kicking off yet another high-stakes chess match on the court.

Oh, and let’s not overlook – every time these Warriors step on the court in the playoffs, it’s not just a test of their athletic mettle but a veritable boon for the NBA rightsholders. TNT and ESPN? They’re absolutely over the moon because, let’s face it, Golden State crowds are a ratings goldmine. The team’s accounting folks? They’re grinning from ear to ear, knowing each home game now becomes an avenue for profit. And if Stephen Curry continues his magical runs into the postseason, all with Jimmy Butler steering his boat with a steadfast hand, the Warriors could be in for a very lucrative run indeed.

Here’s the kicker – the transformation of these Warriors from a franchise that couldn’t find a playoff win to save its life into what can only be described as a financial juggernaut, is a story that should captivate the minds at Harvard Business School. They’ve soared to a valuation of $9.14 billion, putting them just behind the Dallas Cowboys in the annals of global sports franchises. A stunning 20-fold increase from the day Joe Lacob and Peter Guber penned a check for about $450 million way back in 2010.

In those days, Golden State was more synonymous with disappointment than dynasty. They were mired in a playoff drought that had lasted 17 out of 18 years, their coffers empty as the old NBA arena they played in, revenue just a blip on the radar.

But fortune favors the bold, and with the play of warriors like Curry, Klay Thompson, and Draymond Green, the team not only resurrected but soared, gaining the title of Silicon Valley’s darling. The opening of the Chase Center in 2019 and a fortuitous change in the NBA’s playoff revenue structure turbo-charged their newfound success.

This success isn’t going to fade. The Warriors have insulated themselves with long-term sponsorships and ticket deals; they’re the market leaders in everything from suite sales to merchandise, apart from local media. And with $3 billion in contractually locked-in revenue tied to the Chase Center, well, the future looks bright indeed.

LEARN MORE

The Golden State Warriors punched their ticket to the NBA playoffs Tuesday night with a victory over the Memphis Grizzlies in the Play-In Tournament. As the No. 7 seed in the Western Conference, they will face the No. 2 seed Houston Rockets in a series that tips off Sunday.

Companies and fans lined up to lock up long-term commitments for sponsorships and tickets. Sponsorship and premium seating revenue were in the single-digit millions when Lacob bought the team, but are now 0 million and 0 million, respectively. Total revenue is up sevenfold since 2010.

In 2010, Joe Lacob and Peter Guber bought the Warriors for 0 million. The team was in a postseason drought that spanned 17 out of 18 years. It bled red ink playing in the NBA’s oldest arena with a third-quartile revenue ranking while missing the playoffs year after year.

Another run to the NBA Finals would push gross revenue near billion, rare air for sports teams. Only the Dallas Cowboys, Los Angeles Dodgers, Real Madrid and Barcelona have hit the mark in a single season.

Revenue rose with the long playoff runs on the backs of Curry, Klay Thompson and Draymond Green, and the club became Silicon Valley’s “It” team. A pair of moves then made the Warriors’ newfound success even more lucrative: Golden State opened its new arena and the NBA changed its playoff revenue structure.

And even if the winning slows down, the Warriors are insulated to a degree. The average suite deal is 10 years, the average sponsorship deal runs eight years, and almost everything has annual escalators. The Warriors top the league in basically every revenue category outside of local media. They have billion in contractually obligated revenues tied to Chase Center.

The Boston Celtics’ sale document showcased how much the playoffs can goose revenue. Last year’s title run generated 2 million in gross revenue before the NBA took its cut.

The transformation of the Warriors from a perennial money-losing franchise that rarely made the playoffs into a financial juggernaut should be a Harvard Business School case study. The club is now worth .14 billion, second highest among global sports franchises and trailing only the Dallas Cowboys (.32 billion). It is up 20x from what the current ownership paid.

In 2015, the Warriors started a run of five straight trips to the NBA Finals, including three titles. The timing was perfect, as it built momentum and interest in the Chase Center that opened in 2019 as the most expensive arena ever constructed to that point at .4 billion.

NBA rightsholders TNT and ESPN should be pleased, as the Warriors are a massive TV draw. The team’s bean counters are also happy with at least two home games, and potentially many more if Stephen Curry and Jimmy Butler lead a strong postseason run.

The Warriors lost in their Play-In game last year, but they generated million in gross revenue over six home playoff games in 2023, including concessions, merchandise and parking. That is million per game before the Western Conference Finals and NBA Finals where teams have even more pricing power. The club’s last title in 2022 generated well over 0 million from its 12 playoff home games.

Join Sportico for Invest West at the Intuit Dome on May 8

Out of all the major sports leagues, the NBA delivers the biggest financial rewards for its teams that make the playoffs. The league used to keep 45% of home ticket revenue in the playoffs versus 6% in the regular season. In 2016, the NBA reduced its playoff cut to 25%, providing a significant boost in the opportunity for postseason profits. Ticket demand in the playoffs is also elevated, which allows clubs to bump up prices. Games in the NBA Finals are often priced at least 200% higher than their regular-season equivalent. Cutting the NBA’s take of playoff revenue provided even more incentive for teams to maximize pricing.

Golden State’s sky-high value benefits from its multi-use development around Chase Center. The team has also expanded its related businesses with a new entertainment division—Golden State Entertainment—while landing a WNBA expansion franchise, the Golden State Valkyries, that begin play this year.

Post Comment