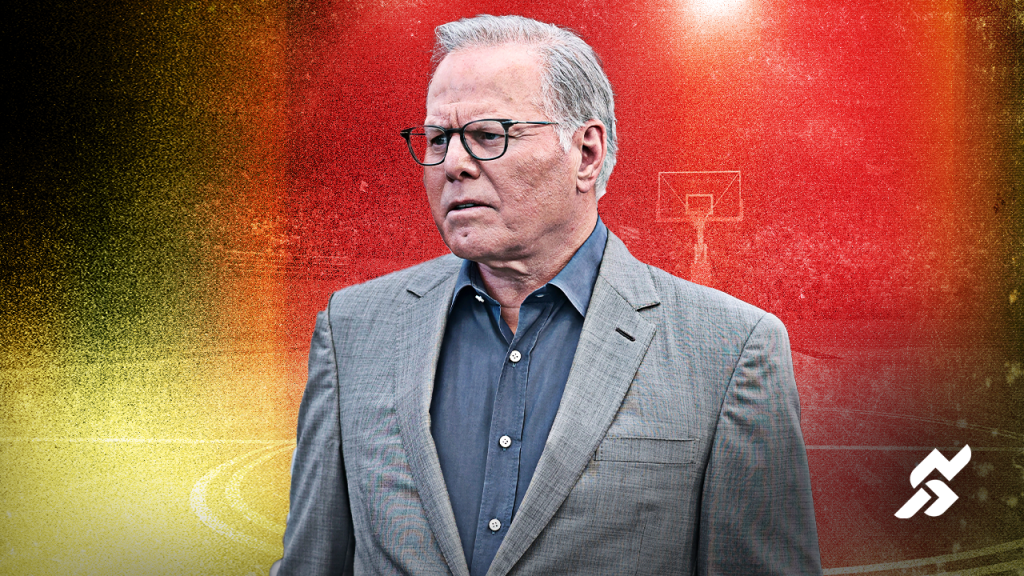

WBD and Zaslav Claim NBA Deal Reports Conceal Shocking Investor Allegations—What’s Really at Stake?

The plaintiffs will have the chance to argue against the motion to dismiss. The case is before U.S. District Judge Katherine Polk Failla.

After WBD and the NBA, who had been in a 40-year partnership, failed to reach a deal during an exclusive negotiation period, the NBA weighed outside bids and accepted ones from NBCUniversal and Amazon. WBD then invoked a matching provision, but the league rejected it. The NBA argued it was not a “match” in a technical sense since it came with revisions to Amazon’s offer, and there was disagreement about whether WBD could distribute NBA games through streaming in the same manner as Amazon. WBD sued the NBA last July for alleged breach of its matching right. The parties settled last November and agreed to a new partnership.

Still another alleged flaw with the complaint, WBD argues, is that the company knew it would fail to keep the NBA but nonetheless acted as if the negotiations were legitimate.

When Warner Bros. Discovery’s top brass, including CEO David Zaslav and CFO Gunnar Wiedenfels, stepped into the legal ring to fend off accusations from WBD stock buyers, they didn’t just raise their hands; they brought a full-throttle argument claiming the securities class action lawsuit simply doesn’t hold water. Investors accuse WBD of playing fast and loose with the truth about last year’s NBA TV rights negotiations—suggesting that crucial details were either glossed over or purposefully left out. But here’s the kicker: the lawyers representing WBD argue that the whole saga was splashed across every sports channel and media outlet imaginable, leaving little room for anyone to claim ignorance. After a four-decade-long partnership, WBD and the NBA hit a bump when negotiations hit a snag—leading the league to lean into rival bids from NBCUniversal and Amazon. WBD tried to use a matching right to stay in the game, but the NBA pushed back, saying it wasn’t a clean match due to tweaks in Amazon’s offer and streaming rights disputes. The squabble even spilled into court last July, only to be wrapped up in a settlement months later. Now, investors are pointing fingers, alleging misleading statements that downplayed the financial hit WBD would endure if it lost the NBA deal. As the back-and-forth unfolds, with legal briefs flying and stock prices jittery, the question remains: did WBD shade the truth, or was this just a complicated dance in big-league sports media rights? The next chapter is waiting to be written in U.S. District Court. LEARN MORE

In addition, the complaint details stock price fluctuations that appeared to be connected to public perceptions about the WBD-NBA negotiations and subsequent fallout. Along those lines, the complaint points out that a “main driver” for WBD and similar broadcast companies is live sports.

From this lens, it wasn’t problematic that Zaslav said during an earnings call in May 2024—a couple of months before a matching period would begin—it was “not the time to discuss” details in the NBA negotiations. During that call he also addressed related topics that were not as sensitive, including “costs, churn and [WBD’s] initiatives on bundles.”

Warner Bros. Discovery CEO David Zaslav and CFO Gunnar Wiedenfels argue in a recent court filing that a federal securities class action brought by purchasers of WBD stock is without merit. The plaintiffs say they were misled by WBD’s statements and omissions about negotiations for a new NBA TV deal last year.

WBD suggests that a theory positing, as WBD puts it, “Defendants knew all along that they would lose the NBA contract and that the months of negotiations were a sham” is illogical and belied by facts.

Numerous news and analysis stories about the negotiations are cited to show investors were exposed to high levels of information about the negotiations.

As the plaintiffs see it, the lawsuit-settlement sequence “demonstrated that, far from believing in their ability to enforce the Matching Clause, Defendants knew that they could not and did not use the Matching Clause to retain the NBA Rights, and instead filed their lawsuit as a face-saving measure and negotiation tactic that WBD quickly abandoned.”

To that end, the complaint references comments from Zaslav, including from 2022 when he told journalists, “we don’t have to have the NBA.” The complaint also cites comments by Zaslav in 2024 when he referenced “constructive and productive” negotiations with the league and when he stated, “we have matching rights that allow us to match third-party offers before the NBA enters into an agreement with them.”

Further, the memorandum draws attention to numerous comments by Zaslav saying negotiations with the NBA were important. The fact that he declined to share all the specifics about the negotiations was to be expected, the memorandum suggests, since business leaders in private negotiations with other companies’ leaders could betray confidences and undermine their bargaining position by revealing too much detail.

For starters, the WBD-NBA negotiations were extremely public in ways that investors and prospective investors of publicly traded companies are normally denied.

That same month, Richard Collura and other investors filed a complaint in the Southern District of New York for violations of the Securities Exchange Act of 1934. The complaint portrays WBD officials as misleading investors as to its ability to employ the matching clause and “omitting the significant financial impact WBD would face if it lost NBA rights.”

WBD also points out that statements made by Zaslav and Wiedenfels were accurate and true. The two men noted that matching rights existed, which was undisputed, without assuring they would be able to exercise those rights without objection by the NBA.

“In fact, the speculation about whether WBD could effectively exercise those rights was also widely discussed in the media,” the memorandum observes. To that point, Sportico and other media detailed dueling arguments as to whether matching rights could apply to the structure of Amazon’s deal, a topic that became the source of a lawsuit before it was resolved via settlement.

“It was impossible to read the sports pages or watch ESPN,” the memorandum notes, “without knowing about the ongoing NBA negotiations, that the negotiations were being monitored obsessively by the media, the industry, and the public, that the outcome was uncertain, and that the outcome would have a financial impact on both WBD and the NBA.”

“Glaringly absent,” WBD writes, “are any particularized allegations to support this argument of fraud-by-clairvoyance.” The company instead cites a more “straightforward inference” that “WBD was engaged in tough negotiations with the NBA and hoped it would secure the NBA rights, but, ultimately, the NBA chose competing offers.”

The memorandum also points out investors and prospective investors could have availed themselves of “the steady drumbeat of disclosures in WBD’s public filings and statements specifically discussing these facts.” Those disclosures, including SEC filings, “expressly warned of the risks” for WBD in losing the NBA deal, including with respect to revenue and goodwill and the importance of maintaining sports content licenses.

Jonathan D. Polkes and other White & Case attorneys representing WBD, Zaslav and Widenfels insist the lawsuit is undercut by “wall-to-wall media coverage of the negotiations” between WBD and the NBA over media rights, talks that spiraled into their own legal controversy.

The complaint argues that the “quick resolution of WBD’s lawsuit against the NBA” is evidence to that effect. The complaint notes that the parties settled “less than four months after WBD filed its lawsuit” and “before any discovery had been completed.”

WBD’s memorandum of law in support of the motion to dismiss contends the case is flawed for several reasons.

“The NBA generated hundreds of millions of dollars annually in advertising revenue, supported WBD’s other sports-related shows, and allowed WBD to charge high carriage rates to cable and satellite providers,” the complaint asserts. It also contends that “the NBA provided WBD with a ‘halo effect’ that boosted all of WBD’s other properties, as well as contributed towards WBD’s non-tangible assets like goodwill.”

Post Comment